The myth of the cursed card

For years, credit cards have been portrayed as the great financial villain for new generations. From alarmist campaigns to well-intentioned advice saying “better not even touch them,” we’ve learned to see them as synonymous with debt, ruin, and lack of control. But what if I told you that the problem isn’t the cards themselves, but the way we were taught to use them?

Pop culture has made debt seem shameful, when in reality, conscious borrowing can be a powerful tool. What makes the difference is control, planning, and a real understanding of how your money works.

Credit as a tool, not a trap

Having a credit card doesn’t make you irresponsible. In fact, it can be one of your best financial allies if you know how to use it with a cool head.

Paying your card on time, not spending more than you can pay off, and understanding how interest works can build you a solid credit history, which later allows you to access bigger loans, better rates, buy a car, or even purchase a house.

It’s not about avoiding debt altogether – it’s about knowing when, why, and for what purpose you’re getting into it.

Timing is everything

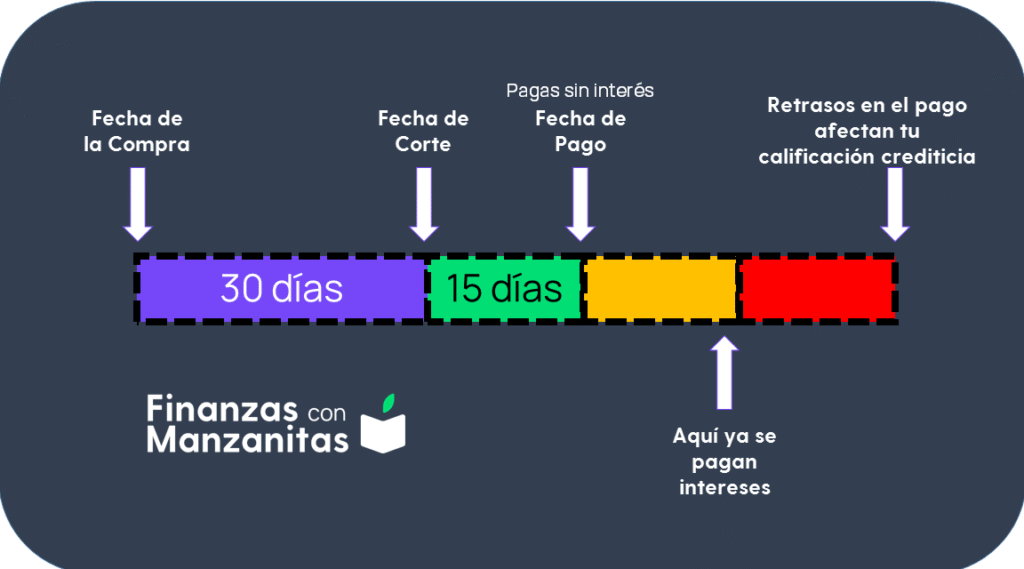

One of the most common mistakes is thinking that paying “minimums” is the same as staying up to date. Spoiler: it’s not. You also don’t need to pay everything in a single billing cycle to avoid charges. Every card has a cut-off date and a payment due date. If you know both, you’re already ahead.

Here’s a practical tip: if you make a purchase right after your cut-off date, you’ll have more days to pay it off without accruing interest. It’s a calendar trick, not magic.

Going into debt isn’t failing – it’s planning

Yes, going into debt intelligently is valid and functional. Many businesses, trips, studies, and even major moves start with a well-used credit card. What isn’t healthy is using it as a lifeline for impulsive purchases or to cover other financial holes.

Thinking that the only “correct” way to use a credit card is for emergencies limits its true potential. You can also use it to build stability, earn rewards, gain points, and take advantage of interest-free promotions.

What they don’t teach you in school

No one teaches us how to use credit cards with a realistic perspective. We’re taught to fear credit, but not to understand it. Sometimes, even the adults giving us advice are just as lost.

Having financial education isn’t about knowing how to invest in the stock market – it’s about knowing if you’re spending more than you earn, knowing your billing cycle dates, and avoiding unnecessary interest payments. It’s simpler than it seems; you just need clear, judgment-free information.

Controlling your spending gives you power, not anxiety

Credit cards aren’t bad if you’re clear about your budget. You can use apps to divide your expenses, or even keep a manual record if you prefer. The important thing is that you control the tool, not the other way around.

And if there’s a month when you can’t pay it all off, don’t beat yourself up. Restructure, adjust, pay what you can, and move forward. Debt can be managed as long as you don’t hide from it.

From Nu to AMEX: there’s a card for every type of person

If you don’t have a credit card yet and want to start simply, Nu (yes, the purple one you’ve probably seen all over social media) is a great option. It not only helps you build credit history from scratch, but it also has super intuitive functions like its “little box,” where you can store money that earns interest while you’re not using it. It’s like having a smart digital piggy bank.

And if you’re on another level, there are options like American Express. Although AMEX can be more expensive in annual fees, it gives you access to experiences, travel benefits, purchase protection, and rewards programs that are truly worth it if you know how to use them.

Here’s the key: every card has its own style. If you choose wisely and use it intelligently, you can turn credit into a tool for financial growth, not a trap. What matters isn’t which card you have, but how you use it.

Educating yourself is more powerful than avoidance

You don’t need to be a millionaire to have financial control. You just need to understand how the system works and use it to your advantage. Credit cards aren’t a sentence to ruin – they’re a tool of power if you learn to use them with intelligence, strategy, and calm. Don’t demonize them – master them.

Check out these tips to manage your credit cards like a pro:

Conoce un poco más del autor:

https://www.instagram.com/alxs._.mapl?igsh=MXVtYjlmYm1pbWR6dA%3D%3D&utm_source=qr